Lendlease Global Commercial Reit posts 3.1% increase in H1 DPU to S$0.0185

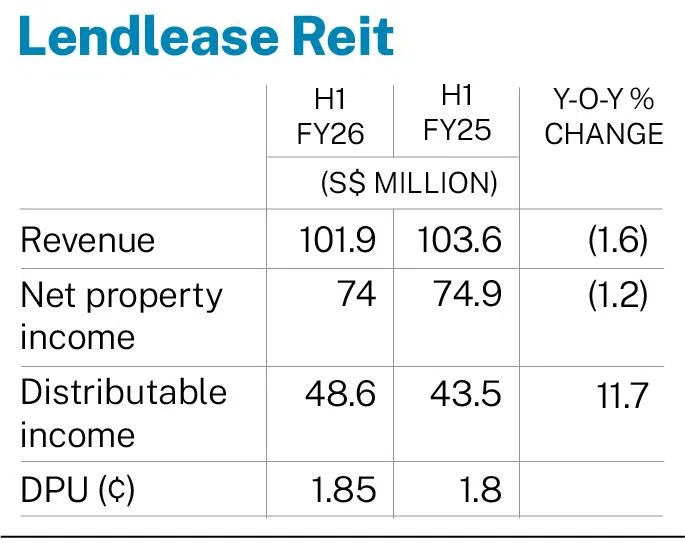

[SINGAPORE] The manager of Lendlease Global Commercial Real Estate Investment Trust (Reit) on Friday (Feb 13) posted a distribution per unit (DPU) of S$0.0185 for the first half ended Dec 31, 2025. This was up 3.1 per cent from S$0.018 in the previous corresponding period.

The higher DPU in H1 of the 2026 financial year followed a resilient performance from the Reit’s Singapore malls, the manager said. It also cited a favourable interest-rate environment, and the refinancing of perpetual securities in April 2025 at lower costs of funding.

An S$8.9 million divestment gain from the sale of Jem’s office component remains available for future distribution, the manager noted. It added that the deployment will be in line with the long-term strategy to deliver stable and sustainable growth in DPU.

The H1 DPU includes an advance distribution of S$0.013305 for period spanning Jul 1 to Nov 13, 2025. This was paid out on Dec 18.

The remaining distribution of S$0.005195 will be paid out on Mar 30, 2026, after the record date of Feb 25.

Distributable income for H1 rose 11.7 per cent to S$48.6 million, from S$43.5 million in the year-ago period.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The manager attributed the increase to lower interest expenses and perpetual securities coupons. But it was partially offset by the divestment of the Jem office and the vacancy that followed Cathay Cineplexes’ lease termination at the property’s shopping mall.

As at Dec 31, the total number of Lendlease Reit’s units stood at nearly three billion, up from 2.4 billion units as at Jun 30. This was due mainly to a private placement to fund the purchase of a 70 per cent stake in PLQ Mall for S$619.5 million.

Last November, Lendlease Reit divested the office component of Jem to a Keppel-managed fund for S$462 million. The sale was aimed at reducing the Reit’s leverage to about 35 per cent on a pro forma basis, and provide a net cash gain of about S$8.9 million for unitholders.

Following this divestment, revenue fell 1.6 per cent to S$101.9 million in H1 FY2026, from S$103.6 million the year before.

Net property income (NPI) was down 1.2 per cent on the year at S$74 million, from S$74.9 million previously.

On a like-for-like basis, excluding the Jem office divestment, revenue and NPI would have been higher by 0.6 per cent and 1.1 per cent, respectively.

The manager said the declines in H1 revenue and NPI were also due to the exit of Cathay Cineplexes. Its replacement tenant – Shaw Theatres – commenced operations in November.

No refinancing risks for FY2026

As at end-December, Lendlease Reit’s gross borrowings stood at S$1.2 billion, and its gearing ratio declined to 38.4 per cent from 42.7 per cent as at Sep 30.

About 72 per cent of its borrowings were hedged to fixed rates as at Dec 31, and the weighted average cost of debt decreased to 2.9 per cent a year, from 3.09 per cent annually as at end-September.

The weighted average debt maturity was 2.5 years, while the interest coverage ratio improved to 1.8 times, compared with 1.6 times as at Sep 30.

The manager noted that there are no refinancing risks in FY2026. “The debt portfolio (remains) fully unsecured, with S$701.2 million debt facilities available to support working capital needs,” it added.

As at end-December, Lendlease Reit’s portfolio committed occupancy was about 95 per cent. Meanwhile, its retail portfolio had an occupancy rate of 99.5 per cent and a positive rental reversion of 10.4 per cent.

In H1, tenant sales and visitation level grew 7.2 per cent and 9.6 per cent on the year, respectively, inclusive of a one-month contribution from PLQ Mall. Without the mall, the respective year-on-year increases would have been 1.1 per cent and 6.2 per cent.

Tenant retention was 64.5 per cent as at end-December, largely because of Cathay Cineplexes’ exit. Excluding the cinema tenant, the retention rate would have improved to 76.8 per cent, the manager said.

The Reit has also started reconfiguring retail spaces at PLQ Mall, with the enhancements expected to drive up rental rates after completion.

Units of Lendlease Reit ended Friday 1.6 per cent or S$0.01 lower at S$0.625, before the release of the results.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.